US TL Market Overview

The US TL market is a dynamic ecosystem that constantly evolves in response to economic, regulatory, technological, and weather disruptions. In this post, we’ll provide an update on the current state of the US TL market, highlighting key trends and insights that can help shippers, carriers, and other stakeholders navigate the road ahead.

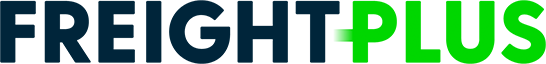

The US economy is currently facing several significant challenges and opportunities.

The residual impact of COVID-19 continues to have major impact on the economy, with supply chain disruptions, labor shortages, and inflationary pressures.

The Federal Reserve's monetary policy and interest rate decisions continue to play a crucial role in shaping our economic outlook. Additionally, geopolitical tensions and global trade dynamics are influencing market sentiment and investment decisions. As we closely monitor these developments, below we will provide updates on their implications for the US economy and the truckload market.

Supply & Demand

Supply of Capacity

In the last quarter, we observed a notable consolidation trend within the US truckload market, evidenced by a 10% decrease in the total number of carriers compared to the previous year. Larger companies continue to absorb smaller carriers, contributing to this decline.

Avery Vise, VP, Trucking at FTR stated, “The number of newly authorized trucking firms marginally exceeded the number of authority revocations net of reinstatements in March… the tiny March 2023 net increase did not signal an inflection. Rather, recent entry and exit changes might indicate a response to temporary developments that occurred three months or so ago.“

Shipper Demand

Consumer behavior remains resilient yet cautiously optimistic. Despite lingering uncertainties, consumer spending has shown steady growth, buoyed by improving employment rates and robust wage gains. However, this growth is tempered by concerns over inflationary pressures, driven in part by supply chain disruptions and rising input costs.

The Federal Reserve's response to this inflationary environment has been closely watched, with interest rates maintained to support continued economic recovery. The specter of inflation looms large, prompting policymakers to navigate a delicate balance between stimulating growth and managing price stability. Supply chain demand remains muted, fueled by industrial production staying down Y/Y.

Imports

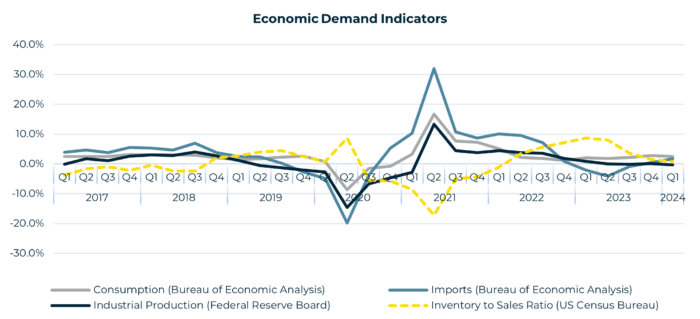

Over the past year, Chinese imports into the US have exhibited a consistent upward trajectory, culminating in record levels during the last quarter. Concurrently, the US government has advocated for heightened tariffs on Chinese steel and aluminum, aiming to address concerns regarding trade imbalances and protect domestic industries.

Meanwhile, China has sought to alleviate its industrial overcapacity dilemma by dispersing excess goods onto international markets, potentially exacerbating trade tensions. This intricate interplay highlights the complexities of global trade dynamics and the ongoing efforts of both nations to navigate these challenges while safeguarding their economic interests.

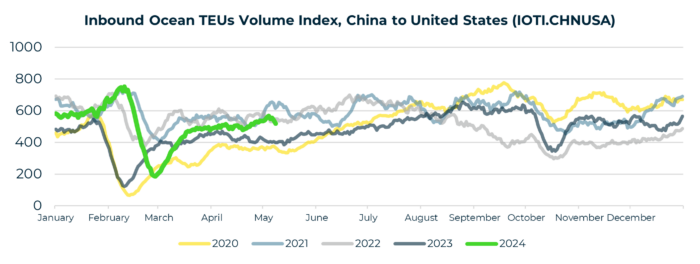

Trade between China and Mexico experienced a remarkable surge, recording a 35% increase over the past year, with a significant portion of these goods ultimately finding their route into the United States. In January 2024, container shipping demand from China to Mexico saw a substantial 60% year-on-year rise, showcasing a strategic maneuver to circumvent the substantial tariffs imposed by the U.S. on direct imports from China.

As it relates to northbound crossings from Mexico into the U.S., January and February 2024, crossings have increased steadily. The number of truck crossings is up 4.3% from the same period in 2023, 16.5% above 2019 levels, and 22.2% above 2018 levels.

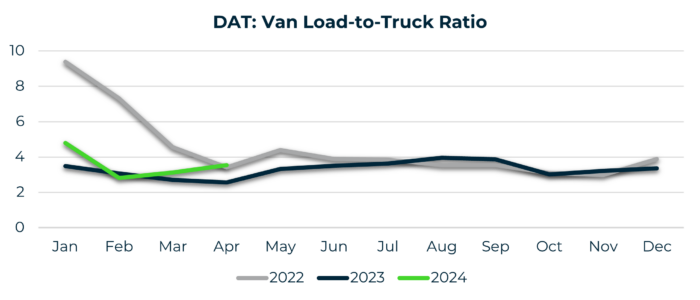

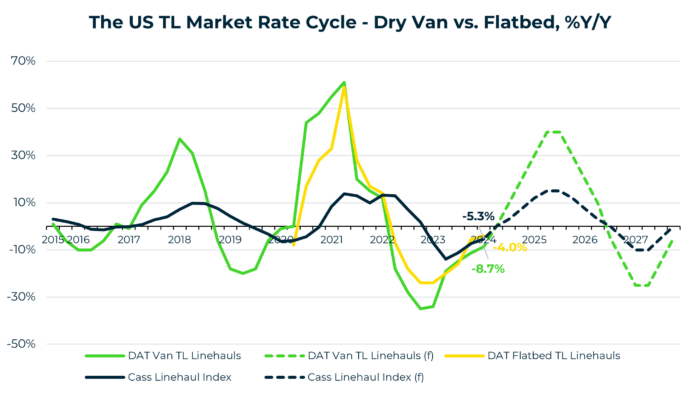

Market Capacity Cycle - Van

Although there have been impressive year-over-year increases in imports and strong retail trade sales, the primary driver of demand for for-hire trucking remains domestic manufacturing and industrial production. Recent data from March indicates that freight demand continues to lag, signaling a lackluster market.

It's evident that the truck freight recession persisted throughout the first quarter, presenting ongoing challenges in the industry despite other positive economic indicators.

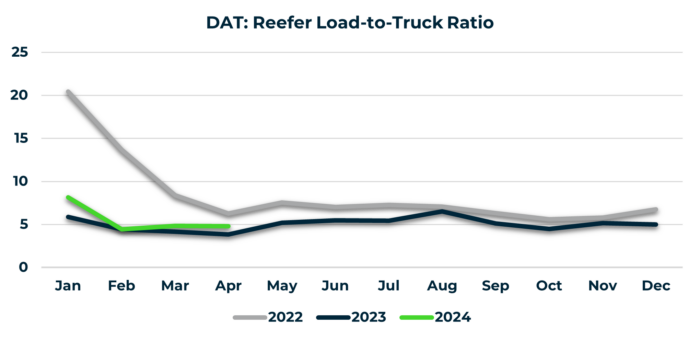

Market Capacity Cycle - Reefer

As we mark the official start of the 2024 produce season, it's worth noting that our current produce volumes are approximately 8% lower compared to this time last year.

Additionally, reefer linehaul rates have seen a slight shift, standing at $0.12 per mile lower than in 2023 but $0.02 per mile higher than in 2019.

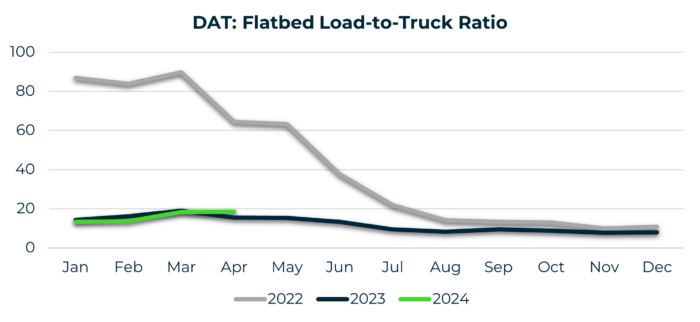

Market Capacity Cycle - Flatbed

The US manufacturing sector is currently experiencing its most robust phase since 2022, as highlighted by the March Manufacturing Purchasing Managers Index (PMI), which revealed the sector's transition into expansion for the first time since September 2022.

Despite this positive momentum, flatbed linehaul rates have maintained a relatively stable position, standing at $0.12 per mile lower compared to last year and $0.01 per mile lower than in 2019.

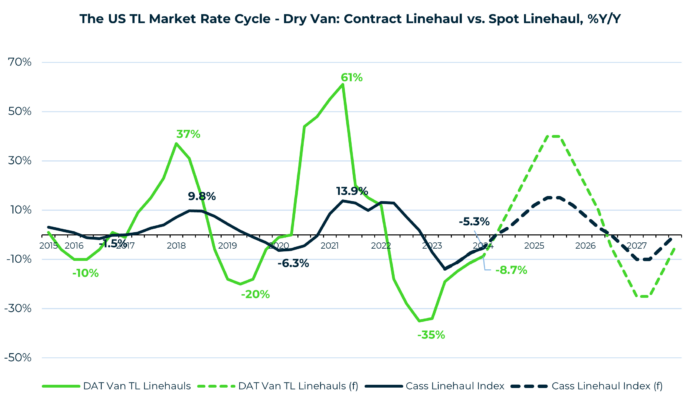

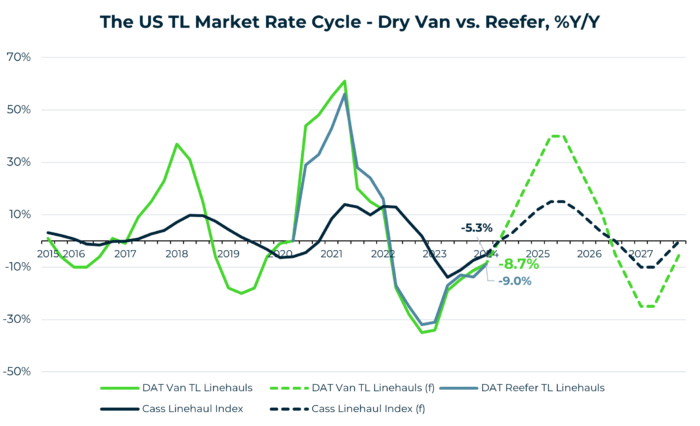

Market Forecast